LAKE COUNTY, Calif. – The Lake County Library will join hundreds of libraries throughout the country on Saturday, Nov. 21, for the eighth annual celebration of gaming in libraries – International Games Day @ Your Library.

Like so many other libraries across the country and around the world, the Lake County Library will offer special gaming programs and events suitable for the whole family at three branches.

The library will supply some board games and patrons are invited to bring games also.

At Lakeport Library the games begin at 10 a.m. and end at 4:30 p.m. Lakeport Library is located at 1425 N. High Street. The phone number is 707-263-8817.

At Redbud Library games begin at 10 a.m. and end at 5 p.m. Redbud Library is located at 14785 Burns Valley Road in Clearlake, telephone 707-994-5115.

At Middletown Library the games begin at 10 a.m. and end at 3 p.m. Middletown Library is located at 21256 Washington St. and the phone number is 707-987-3674.

“Libraries are becoming family destinations, and are continuously offering new formats and innovative programs and services that educate, entertain and expand interaction with their users,” said Christopher Veach, director of the Lake County Library.

“Gaming is yet another example of how libraries are becoming more than just educational resources for the communities that they serve,” Veach said. “They are also places where users of all ages are welcome to have fun together. And if that fun exercises their brains, enables them to meet new people in a safe and enjoyable environment, and celebrates our community’s connection to each other and to libraries on every continent on Earth ... well, that’s just the nature of games!”

International Games Day @ Your Library is an international initiative supported by the American Library Association, the Australian Library and Information Association and Nordic Game Day.

For more information on International Games Day please visit http://ilovelibraries.org/gaming .

The Lake County Library is on the Internet at http://library.lakecountyca.gov and on Facebook at www.facebook.com/LakeCountyLibrary .

Jan Cook is on staff at the Lake County Library.

News

- Elizabeth Larson

- Posted On

Upper Lake woman dies in Highway 20 crash

UPPER LAKE, Calif. – An Upper Lake woman was found dead at the scene of a single-vehicle crash on Highway 20 Wednesday morning.

The California Highway Patrol's Clear Lake Area office said the 51-year-old woman has yet to be positively identified.

The report said the CHP and firefighters responded to the report of a crash at 9:40 a.m. Wednesday on Highway 20 west of Witter Springs Road. The CHP did not give a specific time for when the crash occurred.

The CHP said the woman was driving her 2002 Ford Focus eastbound on Highway 20 at an undetermined speed when, for an unknown reason, she veered off the roadway and the vehicle overturned.

The woman was wearing her seat belt at the time of the crash, according to the report.

The wreck's cause remains under investigation. The CHP said it is unknown if alcohol was a factor in the crash.

Email Elizabeth Larson at This email address is being protected from spambots. You need JavaScript enabled to view it. . Follow her on Twitter, @ERLarson, or Lake County News, @LakeCoNews.

- Lake County News reports

- Posted On

'Stars' award winners honored at 18th annual event

LAKEPORT, Calif. – The Stars of Lake County Community Awards this weekend added 21 new names to its distinguished list of honorees.

The event took place on Saturday evening at the Soper Reese Theatre in Lakeport.

As of Saturday night, the Lake County Chamber of Commerce has awarded 380 Stars since February 1998.

Originally there were 12 categories for nominations and this year that number grew to 21.

Honorees are nominated by residents of Lake County for their acts of kindness, humanity, caring and love of community.

Entertainment for the Stars reception hour was provided by David Neft. Shelly Mascari of the Funky Dozen, accompanied by Patrick Fitzgerald, performed three songs as tributes to the nominees.

A special rendition of the French national anthem was played by Fitzgerald as a tribute to those in France who lost their lives in the attacks on Nov. 13.

After Mascari’s final song of the evening she was presented with a replacement Star for her 2014 Award for Best Idea for The Hero Project. Mascari’s Star was lost when her home was destroyed in the Valley fire.

Chamber President Ted Mandrones thanked the event's many business sponsors. “Stars continues each year as without the sponsors we would not be able to produce the program.”

Major sponsors are The Lodge at Blue Lakes, Calpine Corp., St. Helena Hospital Clear Lake and the Lake County Record-Bee. The video presentation was sponsored by Tony Barthel, Nerds for Normals and decorations by Lake Event Design.

Award category sponsors for 2015 are Cliff and Nancy Ruzicka, Westamerica Bank, Sutter Lakeside Hospital, Lake County Office of Education, Disney Trophies & Awards, SERVPRO of Lake & Mendocino, Savings Bank of Mendocino, St. Helena Hospital Clear Lake, Mendo Lake Credit Union, Konocti Vista Casino & Marina, Foods Etc., Bruno’s Shop Smart, Meadowood Nursing Center, Congressman Mike Thompson, Calpine Corp., Twin Pine Casino/Middletown Rancheria, John Tomkins Tax Consultant, North Lake Medical Pharmacy, Lake County Record-Bee and Strong Financial Network.

The Lake County Chamber of Commerce extended its gratitude to all the volunteers who put the event on at Soper Reese on Nov. 14, and to the Soper Reese Theater staff for their efforts to make this a very successful event.

The board of directors also reminded everyone to send nominations for 2016 to the Lake County Chamber of Commerce at 875 Lakeport Blvd., Lakeport, CA 95453.

“Every year following the Stars program we hear people say, ‘I know someone I was going to nominate, but I let time get away or I forgot,'” said Mandrones. “What people don’t realize is they can nominate all throughout the year. ”

The full list of this year's winners is featured below.

2015 STARS OF LAKE COUNTY RECIPIENTS

Marla Ruzicka Humanitarian of the Year: Barbara Flynn

Senior of the Year: Bob Specht

Volunteer of the Year: Mary Beth Woodward

Student of the Year – Female: Gracie Pachie

Student of the Year – Male: Christopher Vincent

Youth Advocate of the Year – Volunteer: Rick Walker

Youth Advocate of the Year – Professional: Marisol Becerra-Valdez

Agriculture: Sky Hoyt

Organization – Nonprofit: Highlands Senior Center

Organization – Volunteer: Moose Lodge No. 2284

Environmental: Lake County Land Trust

New Business: O’Meara Bros. Brewing Co.

Small Business: The Village Pub

Large Business: Twin Pine Casino/Middletown Rancheria of Pomo Indians

Best Idea: Certified Tourism Ambassador Program

Local Hero: James Wright

Arts – Professional: Lisa Kaplan

Spirit of Lake County: Robert Stark

Woman of the Year: Jeanine Burnett

Man of the Year: Jose “Moke” Simon

Lifetime Achievement: Mike Salter

- Lake County News reports

- Posted On

Valley Fire property owners receive free debris removal

LAKE COUNTY, Calif. – Property owners impacted by the Valley fire are urged to complete a right of entry, or ROE, form before Dec. 1.

Removal of debris will protect the watersheds and prevent environmental damage.

State and federal funds were released and Lake County is able to offer property owners a safe and comprehensive debris removal program using specialized contractors managed by CalRecycle engineers.

Property, including destroyed buildings will be cleared, cleaned and tested at no cost to property owners.

Those who have not submitted a ROE or hired a private contractor by Dec. 1 will begin receiving abatement notices from the county.

They will have 30 days to complete a ROE or hire a private contractor to commence the cleanup themselves.

Starting the first week of January, the county intends to begin abatement of sites for which ROEs have not been submitted or private contractors secured through the assistance of California Office of Emergency Services for the cleanups.

The ROE is a two-page form that takes five to 10 minutes to complete. The form should be submitted to the Lake County Environmental Health Department in person at 922 Bevins Court, Lakeport; by email to This email address is being protected from spambots. You need JavaScript enabled to view it. or by fax at 707-263-1681.

The ROE can be obtained by contacting Lake County Environmental Health or online at http://www.co.lake.ca.us/Government/Directory/Environmental_Health/Valley__Rocky_and_Jerusalem_Fires.htm .

- Denise Rockenstein

- Posted On

Clearlake plans Christmas celebration Dec. 5

CLEARLAKE, Calif. – The city of Clearlake is making plans for a merry Christmas.

The annual Clearlake Christmas Parade takes place beginning at 6 p.m. Saturday, Dec. 5, and will follow a route from Redbud Park to Austin Park on Lakeshore Drive.

This year's theme is "Winter Wonderland," and participants of all ages are being sought.

Trophies will be awarded to the top three entries.

Participants are prohibited from throwing candy and other treats into the crowd; however, walkers may hand items to spectators. Participants must also adhere to other safety precautions as well.

The parade will culminate with the annual tree lighting ceremony at Austin Park, where Santa and Mrs. Claus will be waiting to take pictures with all the children.

Parents are advised to bring their own cameras as a photographer will not be provided.

Hot chocolate and cookies will be provided by the Lakeshore Lions and Lioness.

Entry forms are available at Clearlake City Hall, 14050 Olympic Drive; Enterprise Towing/Big O Tire 15195 Lakeshore Drive; and Bob's Vacuum, 4165 Mullen Avenue, all in Clearlake. There is no cost to participate.

Additionally, a volunteer is being sought to play the part of Santa in this year's event.

For more information or to volunteer, contact the Clear Lake Chamber of Commerce at 707-994-3600.

Email reporter Denise Rockenstein at This email address is being protected from spambots. You need JavaScript enabled to view it. .

- Lake County News reports

- Posted On

Cal Fire transitions into winter staffing

LAKE COUNTY, Calif. – Recent rains and cooler temperatures across the region have lowered the threat of wildfires, allowing Cal Fire’s Sonoma-Lake-Napa Unit to transition to winter preparedness.

The agency said the transition went into effect at 8 a.m. Monday in Colusa, Lake, Napa, Solano, Sonoma and Yolo counties.

In the Sonoma-Lake-Napa Unit, open burning may resume, in the State Responsibility Area lands governed by the unit.

Cal Fire will not require burning permits until approximately May 1, 2016. Before conducting an open burn, contact your local air quality control district to secure an air quality permit and ensure it is a permissive burn day.

For tips on safe burning visit the Cal Fire Web site at www.fire.ca.gov .

As the region shifts towards a winter weather pattern, Sonoma-Lake-Napa Unit Chief Scott Upton encourages residents to remain mindful that one spark is all that is required to start a wildland fire.

Though the risk of wildland fires lessens during the winter months, fires still occur. Wintertime fires can be caused by improper disposal of fireplace or wood stove ashes, neglecting annual chimney maintenance, and escaped control burns.

“Most fires can be prevented,” said Chief Upton.

As drought conditions continue, Cal Fire will maintain staffing to meet local threats, as well as strategically move resources to areas that remain at a higher risk level, if needed.

Cal Fire continues to monitor weather conditions closely and has the ability to increase staffing if weather conditions change or if there is a need to support wildfires and/or other emergencies throughout the State.

Statewide, Cal Fire and firefighters from many local agencies battled more than 5,900 wildfires within the State Responsibility Area that burned 308,000 acres. This is an increase in fire activity, from normal years, with the agency responding to an additional 1,700 wildfires in 2015.

As of January 2015, the Sonoma-Lake-Napa Unit has responded to 520 wildfires that charred 188,053 acres in the Unit.

Learn how to prepare your family and home for wildfire, and also to prevent sparking a wildfire at www.ReadyForWildfire.org .

- Lake County News reports

- Posted On

Authorities warn of identity theft scam hitting North Coast

NORTH COAST, Calif. – Authorities are alerting the community to a new identity theft scam hitting the region.

Capt. Greg Van Patten of the Mendocino County Sheriff's Office said that on Tuesday afternoon the agency learned that the new scam had begun to be perpetrated in Mendocino County.

Beginning a few days ago there has been an automated recording – unlisted or 001 listed in caller ID – that people in the community have been receiving from the "Savings Bank of Mendocino County" indicating the person's MasterCard has been blocked, Van Patten said.

The person is prompted to provide personal identifying information, such as card PIN number and social security number, to get the card reactivated, he said.

This week, Lake County residents also began reporting on social media that they have received similar calls claiming to be from Savings Bank and other financial institutions.

Savings Bank of Mendocino County has subsequently issued a statement urging customers to beware of fraudulent automated phone calls.

If you receive an automated phone call that conveys it is from Savings Bank, it is fraudulent. Do not provide requested information. The bank does not make automated phone calls and will not call customers to activate their debit cards or to ask for account or card information.

The bank will call customers if there is unusual activity and it is suspected to be fraud. In this case, the calls are made in person, not automated."

Anyone who receives any suspicious call of a similar nature should always consult with their financial institution or local law enforcement agency prior to engaging in the requested activity.

Anyone with information that might help to identity the person(s) responsible for this Identity Theft scam is urged to call the Mendocino County Sheriff's Office tip-line at 707-234-2100.

- Alex Sosnowski

- Posted On

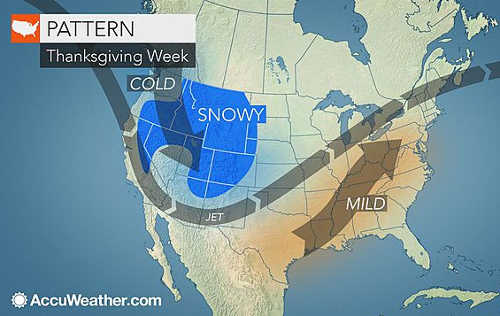

Thanksgiving travel outlook: Snowstorm to slow travel in West, mild air to envelop East

AccuWeather reports as millions of people take to the roads and skies during the week of Thanksgiving, a storm will impact travel in the West, while mild weather continues in much of the East.

According to the American Automobile Association, gasoline prices averaging around $2 per gallon could drive an increase in highway travelers this Thanksgiving.

The majority of people traveling over the eastern two-thirds of the nation should not have snow and ice to contend with from Monday through Wednesday, next week.

As is sometimes the case during mild weather in November, patchy fog could slow down some morning travelers from the interior South to New England. However, the weather in the East is likely to feature the most favorable travel conditions with sunshine.

Spotty showers expected over part of the Florida Peninsula are not likely to impact travel.

Stiff southerly winds could accompany the mild air over the Central states.

The southerly flow may also add enough moisture to the air to cause areas of low clouds and spotty rain or drizzle from parts of Texas to Michigan, Wisconsin and Minnesota.

Thunderstorms may begin to develop in parts of Texas and Oklahoma.

The combination of wind, low clouds and spotty rain could cause minor airline delays on a local basis.

The vast majority of adverse weather conditions for travelers will be in the western third of the nation.

According to AccuWeather Senior Meteorologist Brett Anderson, “We expect another large storm to roll from the Pacific and expand toward the central Rockies during the week of Thanksgiving.”

The storm is likely to spread drenching rain along part of the Pacific coast and heavy snow in portions of the Cascades, Sierra Nevada and the Rockies, spanning Monday to Wednesday.

Travel along parts of interstates 25, 70, 80 and 90 in the higher elevations of the West are likely to be slippery.

Cities that could be directly affected by the storm next week include Seattle, San Francisco, Salt Lake City and Denver.

“The exact strength and timing of the storm is still uncertain,” Anderson added.

If the storm takes a southerly route, then heavy rain and mountain snow may also sweep into Southern California, Arizona and New Mexico. Such a storm track could have significant impact on travel in Los Angeles, Las Vegas and Phoenix.

A southern storm track may also allow the weather to clear quickly in the Northwest.

Cold air and gusty winds will again spill southward over the West next week regardless of the storm track.

AccuWeather will continue to provide updates on the Thanksgiving travel conditions.

Alex Sosnowski is a senior meteorologist for www.AccuWeather.com .

- Lake County News reports

- Posted On

Annual burn ban lifted; permits required for all outdoor burns

LAKE COUNTY, Calif. – The Lake County Air Quality Management District reported that the annual Lake County Burn Ban for 2015 was lifted as of Monday, Nov. 16.

Lake County’s joint fire agencies and air quality management district’s open burning program has incorporated both fire safety and air quality management since 1987.

Burn permits are required for all outdoor burning in the Lake County Air Basin.

Contact your local fire agency for a burn permit, or the Lake County Air Quality Management District at 707-263-7000 to obtain a smoke management plan.

A smoke management plan is required for all burns over 20 acres in size, multi-day burns, standing vegetation burns, whole tree or vine removals over one acre, and other burns where significant smoke impacts may occur or sensitive receptors may be impacted.

A fee is required for all burn permits, payable at the time the permit is issued. Burn permits (agricultural and residential) and smoke management plans are $24, while land development/lot clearing burn permits are $74.

Only clean dry vegetation that was grown on the property may be burned.

Residential burn permits require a one-acre or larger lot, a burn location that is located at least 100 feet from all neighbors and at least 30 feet from any structure.

Lot clearing/land development burns require special permits available at your local fire agency. Contact your local fire agency or the Lake County Air Quality Management District for lots smaller than one acre in fire-damaged areas.

Burn only the amount of material that can be completely consumed during the allowed burning

hours. Read your burn permit carefully and follow all the conditions.

Consider using the vegetative waste pickup provided with your waste collection services or composting as an alternative to burning leaves. Contact your local fire safe council for chipping information.

For residents of the South Lake Fire Protection District, call 707-987-9841 or go to www.southlakefiresafecouncil.org . For all other areas in Lake County, call 707-263-4180, Extension 106.

Officials ask those who plan to do burning to please be considerate of their neighbors. A permit does not allow you to create health problems for others and you can be liable for health care costs, fines and other costs resulting from your burning.

- Lake County News reports

- Posted On

State controller finds widespread deficiencies in state Board of Equalization fiscal controls

California Controller Betty T. Yee on Wednesday announced that her team’s detailed review of the state Board of Equalization’s accounting and administrative controls identified material weaknesses in how the board allocates retail sales and use tax.

In some cases, this led to state revenue being deposited in the wrong accounts, Yee reported.

The review team also discovered weaknesses in the board’s oversight of its internal revolving fund used for salaries, travel, and vendor payments.

“The board is entrusted with making sure tax dollars get to the right places,” Controller Yee said. “I am deeply concerned that the board is falling short in this crucial mission. The board must implement more internal controls, train staff, and break down silos that are detrimental to sound administration.”

Before being elected controller – the state's chief fiscal officers – Yee had served two terms on the Board of Equalization, representing part of Northern California that included Lake County.

In response to the controller’s findings, BOE Executive Director Cynthia Bridges wrote that the board is committed to strengthening fiscal controls and communication.

An internal review, dated June 30, led board staff to develop an action plan to address weaknesses, Bridges wrote.

The controller’s review team noted that the board did not describe improvements that were under way before they saw the controller’s report. As a result, the controller’s team could not assess the board’s action plan.

Other Board of Equalization members also responded to the findings Wednesday.

“This is the board's highest priority right now. We are developing a strategy with the executive director and management team to resolve these issues rapidly. California taxpayers should always have confidence that the state is managing their taxes efficiently,” said Vice Chair George Runner.

Fiona Ma, who now represents Lake County on the Board of Equalization, noted that Yee's audit raises a number of disappointing and troubling issues.

“As a Certified Public Accountant, it is unacceptable to me that a tax and auditing agency would fail to perform and carry out its basic responsibilities and functions,” Ma said.

Ma said that, based on the 11 months she's served on the state Board of Equalization, she believes the issues arose from a lack of transparency and oversight in agency operations.

“At our next board hearing, I will be introducing a motion to create a standing Auditing and Oversight Committee of the state Board of Equalization to ensure that these issues not only get corrected but stay corrected,” she said.

Ma also commended Yee for her leadership and diligence in conducting the audit, and added that she is “committed to working with Controller Yee and my colleagues on the board to correct these glaring problems immediately.”

The Board of Equalization was established by a state constitutional amendment in 1879 to ensure uniformity of property tax assessments throughout California.

Today, the board collects the retail sales and use tax, property taxes, and special taxes, as well as handling appeals of tax cases.

In the 2013-14 fiscal year, the board collected $48.5 billion in retail sales and use tax revenue, accounting for more than 24 percent of all state revenue.

Among the review’s findings:

· The board lacks adequate controls over the retail sales tax fund, rendering it unable to timely detect errors. In one case, the controller’s team found that the state general fund – the source of most spending – got $47.8 million too much, while other funds were shortchanged that amount.

· The board suffers from a lack of reliable information and communication among its staff units. As a result, revenue collection staff may be unaware of what is included in statistical reports used to determine tax allocations or the effects of new laws and regulations on allocations.

· In quarterly reconciliations of tax revenue allocations, the board improperly counted items that should have been left out, and made incorrect adjustments, leading to misallocations of funds.

· The board’s Office Revolving Fund (ORF) did not collect debts in a timely manner, including travel advances, salary advances, and payments due from various vendors. Vendor payments through the ORF – which should have gone through a normal claims process – opened the door to misuse of state funds. Employees did not sign forms requesting salary advances, and the controller’s reviewers could find no evidence advances were approved by managers or supervisors.

- Elizabeth Larson

- Posted On

Postal inspectors investigate Upper Lake break-in

UPPER LAKE, Calif. – The United States Postal Inspection Service is working to solve a break-in that targeted the Upper Lake Post Office.

The Postal Inspection Service, the law enforcement arm of the United States Postal Service, is investigating the burglary to the facility, located at 9435 Main St., which occurred in early September, according to Postal Inspector Jeff Fitch.

He said the burglars did some damage in breaking into the building and taking mail from post office boxes.

On the night of the incident he said postal inspectors responded and conducted crime scene processing.

Fitch said the investigation remains active.

Lake County is part of the US Post Office's San Francisco postal district, said Fitch.

“When we look at our territory, we see other break-ins like this,” he said. “They are rare but they do happen.”

He added, “The real key is the reporting.”

Anyone who has information about the crime or who committed it is asked to call the United States Postal Inspection Service toll-free dispatch number 24 hours a day, seven days a week, at 877-876-2455.

If someone who has a post office box at the facility notices unusual transactions on credit card or bank statements, Fitch also asked that they call to report it.

Fitch said there is a standing reward of up to $10,000 leading to the arrest and conviction of those responsible.

He said breaking into a post office is a federal office, with a potential penalty of up to five years in prison and a $250,000 fine.

“It is something we are very serious about,” Fitch said.

Email Elizabeth Larson at This email address is being protected from spambots. You need JavaScript enabled to view it. . Follow her on Twitter, @ERLarson, or Lake County News, @LakeCoNews.

- Lake County News reports

- Posted On

Officials: One week left to register with FEMA and apply for SBA disaster loans

LAKE COUNTY, Calif. – Monday, Nov. 23, is the last day that wildfire survivors in Lake County can register to receive housing or other needs assistance grants from the Federal Emergency Management Agency and apply for disaster recovery loans from the U.S. Small Business Administration (SBA).

It will be day 60 since President Obama declared the massive wildfires in the two counties to be major disasters, which enabled FEMA to provide federal recovery grants to qualified registered applicants.

The declaration also enabled the SBA to offer low-interest disaster loans to businesses of all sizes, private nonprofits, homeowners and renters for physical damage, personal property losses and economic injury.

Monday, Nov. 23 is also the last day to visit the three open Disaster Recovery Centers (DRCs).

In-person registration is available at Lake County's two DRCs, located at 14860 Olympic Drive in the Burns Valley Mall in Clearlake and at the Middletown Senior Center, 21256 Washington St.

Hours are Monday through Friday, 8 a.m. to 6 p.m.; Saturday, 9 a.m. to 4 p.m.; closed on Sunday.

To further meet the needs of wildfire survivors, on Tuesday, Nov. 24, the Middletown facility in Lake County will open an hour later, at 9 a.m., and transition to an SBA Disaster Loan Outreach Center (DLOC). Hours will be Monday to Friday, 9 a.m. to 6 p.m.

The Clearlake Disaster Recovery Center will close permanently at 6 p.m. on Nov. 23.

The Middletown DLOC will be closed from Thanksgiving Day through the weekend, reopening on Monday, Nov. 30.

At the DLOC, disaster loan applicants will be able to meet with SBA representatives to finalize applications started before the Nov. 23 deadline. The SBA DLOC will be open until further notice.

Applying for an SBA low-interest disaster loan is part of federal disaster assistance. Many people who apply to FEMA are automatically referred to the SBA for a low-interest disaster assistance loan. Survivors should complete SBA loan applications so they can be considered for all available disaster assistance.

The Economic Injury Disaster Loan (EIDL) program is also available to small businesses that did not suffer physical losses, with an application deadline open until June 22, 2016.

As of Monday, between Lake County and Calaveras County – the latter being the site of the Butte fire – FEMA has approved nearly $10.7 million to help individuals and households recover; more than $7 million for housing and nearly $3.7 million for other needs assistance.

The SBA has approved nearly $14.4 million in low-interest disaster recovery loans, nearly $1.8 million to businesses and private nonprofit organizations and nearly $12.6 million to homeowners and renters. Those numbers also are a combination of what has been granted for both the Valley and Butte fires.

Registration with FEMA – easily done by telephone, online or in-person – is required to become eligible for housing or other needs assistance.

Survivors can register for FEMA assistance online at www.DisasterAssistance.gov or by calling 800-621-3362; TTY 800-462-7585; 711 or Video Relay Service (VRS), call 800-621-3362.

After online and telephone registration ends at midnight Monday, Nov. 23, the same contact numbers can be used to ask FEMA about pending applications or other issues.

A direct telephone hotline is operational to process any requests from survivors who may need additional assistance: 916-381-0330, for TTY, call 711.

For more information on California’s wildfire recovery, visit www.caloes.ca.gov or www.fema.gov/disaster/4240 and follow the agency on Twitter @femaregion9 and @Cal_OES and on Facebook at www.facebook.com/FEMA and www.facebook.com/CaliforniaOES .

LCNews

Responsible local journalism on the shores of Clear Lake.

Memberships:

|

|

|

|

|

|